First Nations to share taxes on new mines

Source: Winnipeg Free Press

Written by: Martin Cash

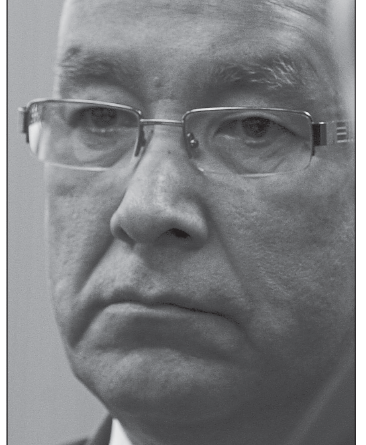

Photo: Norway House Chief Ron Evans: ‘This is progress.’

The province has agreed to share up to 25 per cent of mining taxes on new mines with First Nations communities whose traditional lands are affected.

The agreement has been in the works for a couple of years and is part of a series of developments in the mining and exploration business that has brought industry, government and First Nations much closer together.

“Given where we were, and where we are now, this is progress,” said Ron Evans, chief of Norway House Cree Nation and the co-chairman of the two year-old mining advisory council.

“It takes a lot of understanding on both sides to get to this point.”

The agreement on pooling 25 per cent of newmine mining taxes may be the most generous and comprehensive resource industry revenue-sharing deal for First Nations in the country.

Because of brutally low global commodity prices, the province is not collecting much from mining taxes now, which is paid from profits. But it could be a significant amount at some point.

Commodity prices — and hence the profitability of the mining industry — are cyclical.

For instance, in its heyday in the last decade, the province collected close to $100 million in mining taxes in a good year.

In addition to that agreement, the parties have contributed to producing two new publications: Guidelines for Mineral Exploration in Manitoba and the Aboriginal Engagement Handbook. They are available on the Mining Association of Manitoba website.

Dave Chomiak, Manitoba’s mines minister, said while it might take some time before a new mine comes on stream and starts contributing to this new set-aside, the agreement will be a good foundation for First Nations in the future.

“This is a significant move forward,” Chomiak said. “It has been a very good experience in trust.”

Most agree the existence of the advisory council — made up of representatives from nine First Nations, industry and government officials — has been integral to getting these agreements in place.

Rob Winton, the vice-president in charge of Manitoba operations of HudBay Minerals, is the co-chairman of the advisory council.

“Supporting Manitoba to become a top jurisdiction for mining and mineral exploration will benefit us all. Forums such as this have helped significantly improve the mutual understanding of our issues and opportunities, making it clear that together, we are better,” he said in a statement.

Tim Friesen, executive director of the Mining Association of Manitoba, said even though this new tax sharing does not directly affect his members —because it comes out of provincial coffers — the industry has supported the process. He said the new publications on exploration and First Nations engagement guidelines will create more clarity and certainty in the industry.

The details about how the 25 per cent share of the mining tax will be distributed may be altered over time.

The general sense is the First Nation whose traditional lands are affected by a new mine will receive 65 per cent of the off-set, the rest of the participating First Nations will receive 20 per cent and the recently created First Nation Mining Economic Development Inc. will receive 15 per cent.

That entity, which received seed funding from the province last year, was created to help build capacity within participating First Nations so they can take part in the industry that services mining activity, worth $1 billion annually.

Glenn Sanderson, who heads up that organization, said since commodity prices are so low, now is a good time for skills development to start.

“It is a very complex industry, and there is a lot of work for us to do,” he said.

For example, he said the training of prospectors is underway.

“Then we’ll have to show them how to stake a claim, and show how flow-through funding works so they can go out and find money based on the strength of their claims,” he said.